Retrieval-Augmented Generation Systems: A New Perspective on Artificial Intelligence

## What Are Retrieval-Augmented Generation Systems?

Retrieval-Augmented Generation (RAG) systems represent a class of artificial intelligence that merges the capabilities of generative models with information retrieval technologies to improve the context and relevance of generated content. These systems use a dual-component approach: first retrieving relevant information from a large database or knowledge source, and then using this information to generate responses that are informed and contextually appropriate.

### The Mechanics of RAG Systems

At its core, a RAG system, like vectorize, operates in two main phases: the retrieval phase and the generation phase. In the retrieval phase, the system searches through a vast repository of data — which could include documents, databases, or even the entire internet — to find information that matches the input query. This phase is crucial because the quality and relevance of the information retrieved directly impact the output.

Once the relevant information is retrieved, the generation phase begins. In this phase, the system uses a language model, like those seen in some of the most sophisticated AI platforms today, to construct responses that synthesize both the retrieved information and the original query. This approach allows the system to produce responses that are not only accurate but also rich in context and detail.

## Applications in Various Fields

### Enhancing Customer Support

One of the most immediate applications of RAG systems is in customer support. By integrating RAG technology, support systems can provide answers that are not only immediate but also highly relevant to customer queries. This not only speeds up response times but also improves customer satisfaction by providing more accurate and helpful information.

### Innovating Research and Development

In research and development, RAG systems can accelerate the review of existing literature, suggest connections between different research areas, and even propose novel hypotheses. Researchers can benefit from quick access to a broad array of documents and datasets, allowing them to synthesize new information more effectively.

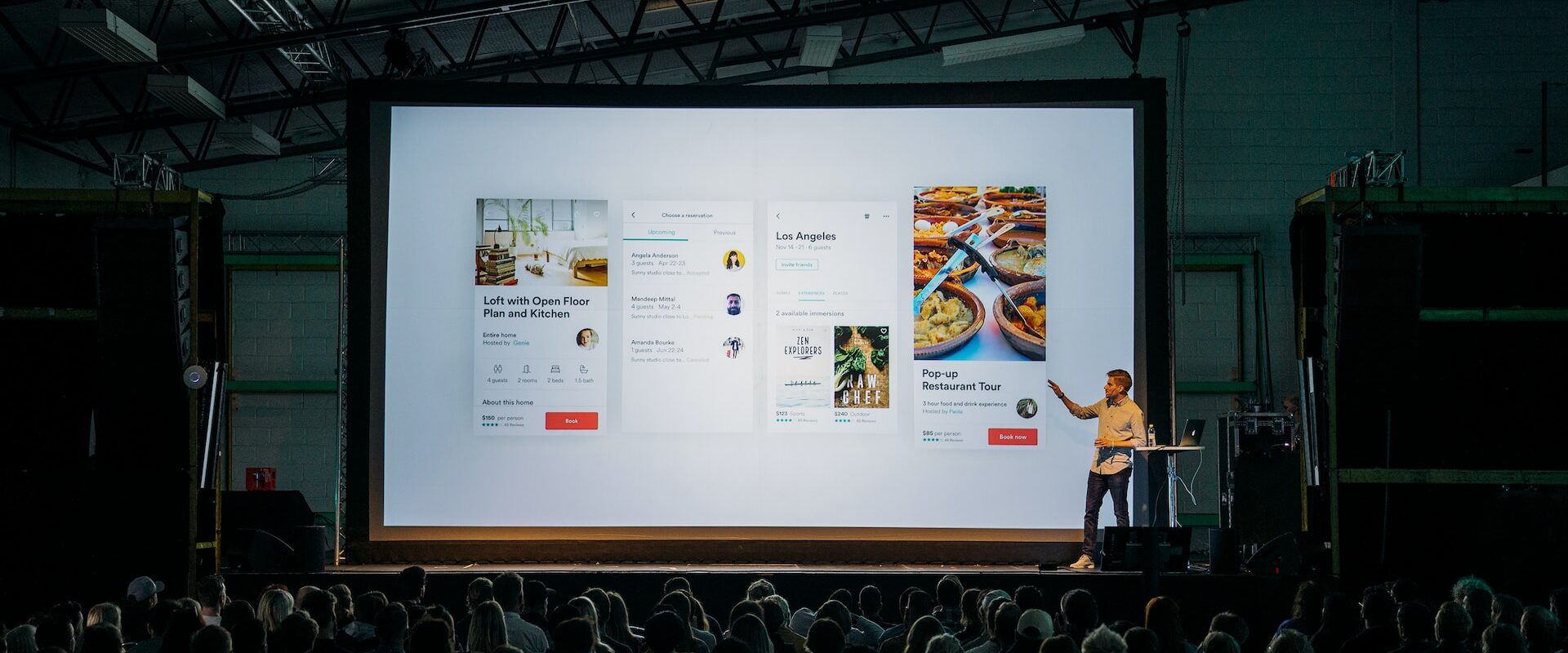

### Media and Content Creation

In media and content creation, RAG systems offer the ability to generate rich, informed content quickly. Journalists and content creators can use these systems to pull in relevant data and statistics, craft detailed and informed narratives, and ensure their content is accurate and comprehensive.

## Benefits of Using RAG Systems

### Improved Accuracy and Relevance

By leveraging the vast stores of data available and combining this with powerful generative AI, RAG systems can drastically improve the accuracy and relevance of AI-generated responses. This is especially valuable in fields where precision and detail are paramount.

### Efficiency and Speed

RAG systems significantly reduce the time needed to gather information and generate responses. This increased efficiency can lead to cost savings and improved productivity across a variety of sectors.

### Scalability

As data continues to grow exponentially, RAG systems provide a scalable solution that can continue to perform at a high level, regardless of the volume of data. This scalability is critical for businesses and organizations looking to grow and adapt in a data-driven environment.

## Future Prospects

As RAG technology continues to evolve, its integration into various sectors will likely expand. The ability to quickly generate informed, relevant content has vast implications for many fields, including education, healthcare, finance, and legal industries. As AI continues to advance, the potential for RAG systems to become a fundamental component of many technologies is enormous.

In conclusion, Retrieval-Augmented Generation systems are reshaping the way AI interacts with information, offering more intelligent, context-aware responses that harness the power of both retrieval and generative technologies. The integration of these systems into daily operations across various industries could not only enhance operational efficiencies but also lead to more informed decision-making and innovation.

About How Payday Loans Work

About How Payday Loans Work