Top 10 Must-Visit Attractions in Gangnam for First-Time Travelers

Gangnam, one of the most vibrant and exciting districts of Seoul, is famous for its luxurious shopping, modern skyscrapers, and buzzing nightlife. While many people know it because of the global hit “Gangnam Style,” there is so much more to this area than just its pop culture fame. For first-time visitors, Gangnam offers a variety of attractions that blend modernity with tradition, making it an unforgettable experience. Here’s a guide to the top 10 must-visit spots that you won’t want to miss.

- COEX Mall and Starfield Library

One of the largest underground shopping malls in Asia, COEX Mall is a haven for shoppers and entertainment seekers. Not only does it offer countless stores, restaurants, and entertainment options, but it’s also home to the famous Starfield Library, an architectural masterpiece filled with towering bookshelves. This open space is perfect for relaxing, grabbing a coffee, or even catching up on some reading. The mall also houses an aquarium and a cinema, making it a complete experience in itself.

- Bongeunsa Temple

Just across from the futuristic COEX Mall lies Bongeunsa Temple, a peaceful and historical Buddhist sanctuary. Founded in 794, this temple offers a serene atmosphere, perfect for those looking to escape the busy streets of Gangnam. The towering statue of Maitreya Buddha and the colorful temple grounds provide a glimpse into Korea’s rich spiritual heritage. It’s the ideal place to find a moment of tranquility amidst your bustling trip.

- Apgujeong Rodeo Street

If you’re a fan of fashion and high-end shopping, Apgujeong Rodeo Street is a must-visit. Known as the “Beverly Hills of Seoul,” this street is lined with designer boutiques, trendy cafes, and luxury goods. It’s also a favorite spot for celebrity sightings. Even if you’re not in the mood to shop, walking around Apgujeong Rodeo Street is an experience in itself, with its chic and glamorous atmosphere.

- Gangnam Station and Underground Shopping Mall

Gangnam Station isn’t just a transportation hub; it’s a vibrant area full of life, offering an underground shopping experience that stretches for blocks. Here, you can find affordable fashion, accessories, and cosmetics, making it a great spot for those looking to grab trendy items without breaking the bank. The area above the station is also packed with restaurants, bars, and cafes, perfect for grabbing a bite or soaking in the energetic ambiance of Gangnam’s nightlife.

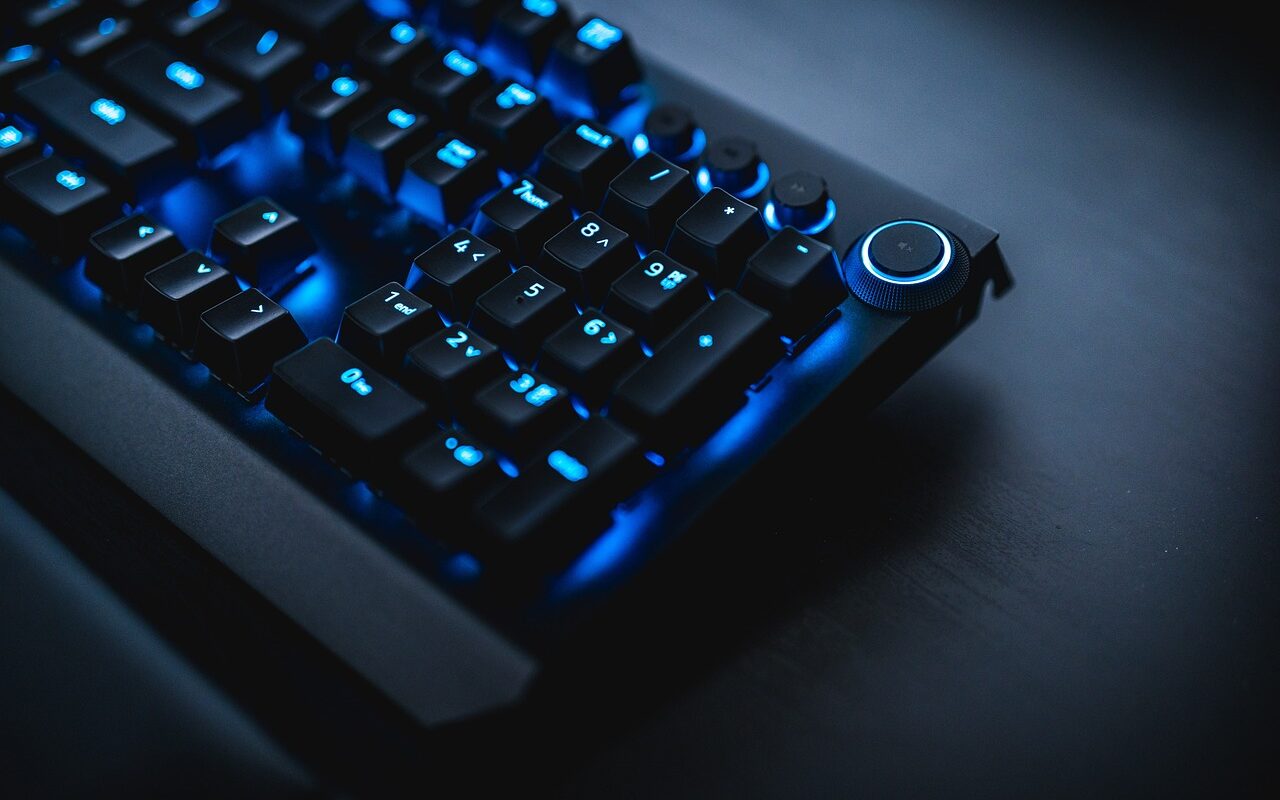

- Samsung D’Light

If you’re interested in technology and innovation, Samsung D’Light is a fun and interactive stop. Located at the Samsung headquarters, this exhibition space allows visitors to explore the latest in technology, from smartphones to futuristic gadgets. It’s a tech lover’s paradise where you can play around with innovative products and even get a glimpse of Samsung’s future ideas.

- K-Pop Entertainment Agencies

For K-pop fans, Gangnam is home to some of the most famous entertainment companies, such as SM Entertainment, JYP Entertainment, and Cube Entertainment. While you might not be able to go inside, many fans gather around these offices in the hopes of spotting their favorite idols. The area around these agencies is filled with K-pop-themed cafes and shops, making it a pilgrimage spot for music lovers from around the world.

- Seolleung and Jeongneung Royal Tombs

A UNESCO World Heritage Site, these royal tombs offer a unique blend of history and nature. The resting place of two Joseon Dynasty kings and their queens, Seolleung and Jeongneung provide a peaceful and green environment to take a stroll. It’s a quiet escape from the city’s fast pace, where you can admire ancient Korean architecture and learn about the country’s royal history.

- Sinsa-dong Garosu-gil

Garosu-gil in Sinsa-dong is one of the trendiest streets in Seoul, famous for its tree-lined avenue, boutique shops, and artistic cafes. Whether you’re in the mood for a leisurely walk, some retail therapy, or a delicious meal, Garosu-gil has it all. The street is also known for its photogenic spots, making it a favorite among Instagram users. From unique fashion boutiques to cozy dessert cafes, it’s the perfect place to spend a relaxing afternoon.

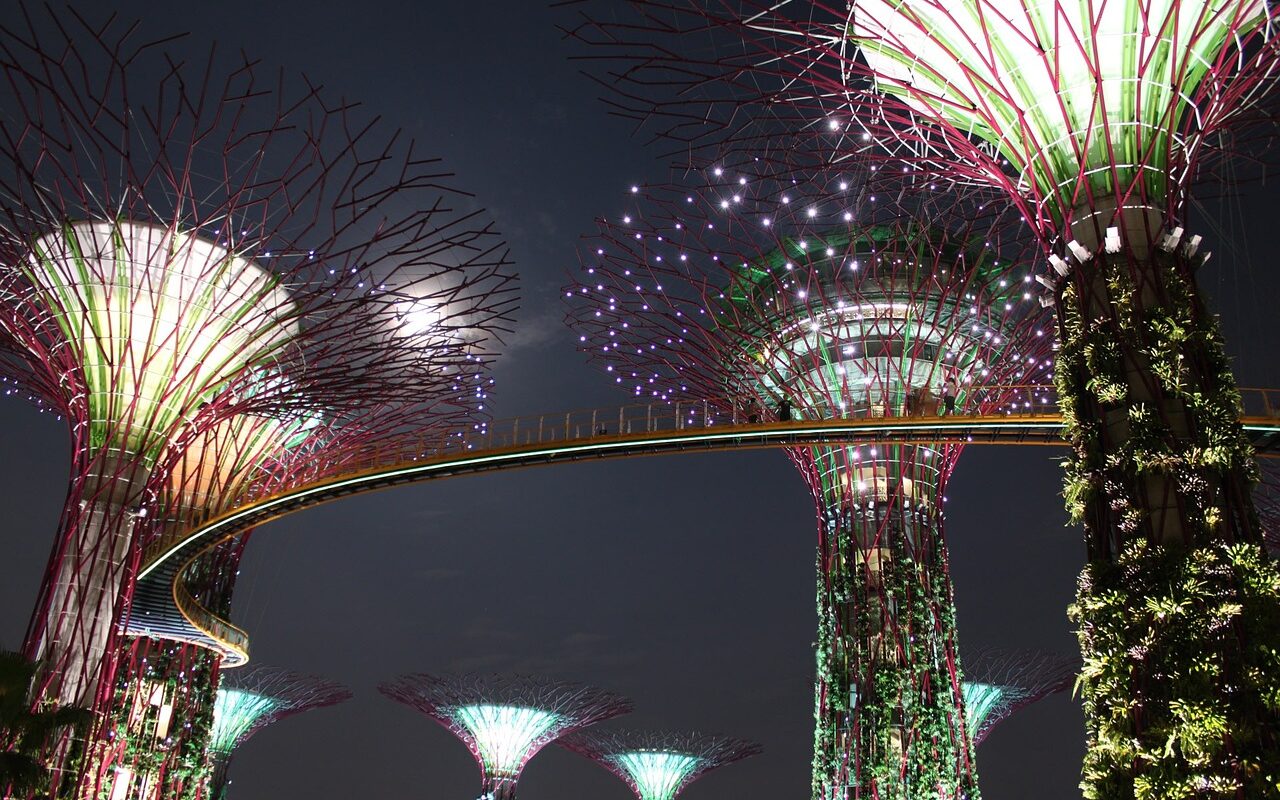

- Karaoke Rooms (Noraebang)

No visit to Gangnam would be complete without experiencing a karaoke room (see https://gangnam-playshirtroom.com), or *noraebang*. Known for their lively and fun atmosphere, these private karaoke rooms are a beloved part of Korean culture. Gather your friends, pick your favorite songs, and sing your heart out in a cozy room filled with music and lights. In Gangnam, you’ll find some of the most high-tech and luxurious *noraebang* venues, complete with excellent sound systems and large song libraries. It’s a fantastic way to end the night with a group of friends after exploring the city.

- Dosan Park

For a quieter, more nature-filled experience, Dosan Park is a beautiful and relaxing park in Gangnam. Named after the Korean independence activist Dosan Ahn Chang-ho, this park is an ideal spot for a morning walk or an afternoon picnic. The lush greenery and well-maintained paths offer a peaceful environment away from the city noise. It’s also a popular destination for locals, giving you a taste of daily life in Seoul.

The Perfect Blend of Tradition and Modernity

Gangnam offers an incredible mix of attractions, from luxurious shopping districts and futuristic tech experiences to serene temples and peaceful parks. For first-time travelers, this district provides a taste of Seoul’s energy and charm. Whether you’re exploring the latest trends in fashion, singing the night away in a karaoke room, or soaking in the tranquility of a historical temple, Gangnam has something for everyone. It’s a destination that blends the old and the new, and it’s sure to leave any visitor with lasting memories.